Over the years I’ve heard and read a lot of advice on how to get a technical co-founder. Having a mostly non-technical background myself, I’ve been facing the issues of having a “great” startup idea without having the technical chops to build it myself.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Here's what I found impacting.

Your new post is loading... Your new post is loading...

Guillaume Decugis's curator insight,

February 24, 2014 9:52 PM

Interesting point of view of Tomasz Tunguz on what the AppStore model had to do in WhatsApp's massive valuation. I'm not sure I agree with everything he writes though. Yes, the AppStore is very competitive and the old tricks don't work there. Yes, increased competitions and a short-tail distribution means higher outcomes and rewards for those who make it. But I'm not sure the model is that virtuous: - first, I'm not sure it favors innovation that much: web sites are optimized on a daily basis (or actually often multiple changes per day) while Apps need to go through approval processes and tests, etc... - second, as Andrew Chen pointed out, this hit or miss market the AppStore is means that mobile startups are failing without a second chance to iterate and come out with the right product.

Terrence Bristol's curator insight,

March 14, 2014 1:22 PM

I think this should apply to any business especially when in early phases of starting. A community helps you get over those rough spot when your doubts are high and confidence is low.

Marshall Van Fleet's curator insight,

January 19, 2014 3:12 PM

Good Advice For The Start-up Entrepreneur As Well

Sabra Kay's curator insight,

March 3, 2014 6:16 PM

I wholeheartedly agree, and adding to that, I think now is a great time to start something small. To work for yourself, in any niche you choose and to make something of it. It doesn't have to be a high-tech, VC funded startup, it can just be your "thing." If there was ever a time to do it, it's now.

Lori Wilk's curator insight,

December 15, 2013 11:50 AM

As we launch, we want to build on a structure and a solid foundation, most of us have lots to learn.

Lori Wilk's curator insight,

December 23, 2013 10:30 AM

It's great to learn from what others have tried and experienced so that you can be better prepared.

Lori Wilk's curator insight,

December 23, 2013 10:35 AM

As we read this article there is someone out there who has the idea and will make this question their reality. The odds are that we will read their story in the next 24 months to 36 months.

Alba Redin's curator insight,

December 1, 2013 7:07 AM

Successful entrepreneurship, who succeed? THose companies who are different, Game changers (they aim to compete on different terms), market entry and tey are in essense guerillas.

Ranjit Kovilinkal's curator insight,

December 2, 2013 11:08 PM

The culture of big risk taking has to fall in place in India for something really big to emerge! Any comments?

Samu Tuomisto's comment,

November 6, 2013 3:44 PM

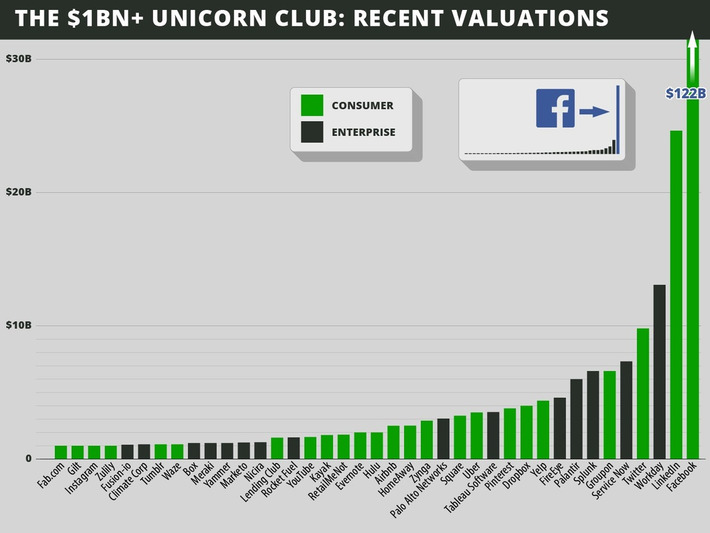

Trust on your vision? No pivot made in 90% of One-Billion Dollar Software Startup Companies.

GreatBusinessContent's curator insight,

October 9, 2013 5:51 PM

Cash flow equals freedom. If you have cash flow you can decide the direction your company moves. Without cash flow you are very limited in options and anyone who has helped you finance can begin calling the shots. If you're bootstrapping you will just slowly fade away.

This is a very well written account of how a high tech startup began working for cashflow.

Ally Greer's curator insight,

September 29, 2013 6:52 PM

From Guillaume: " Of course this form of bootstrapping doesn't scale but we know it doesn't matter: http://sco.lt/6n1fhh " |

Curated by Guillaume Decugis

CEO of @Linkfluence (#AI for #SocialListening and #marketresearch). Entrepreneur (@Scoopit, Musiwave, Goojet). Engineer-turned-marketer. Rock singer.

Other Topics

Actualités Corona Virus

Content curation trends

How content curation is making the Web smarter.

Content marketing automation

A look at how automation and artificial intelligence technology enables content marketers to generate ROI.

Corona Virus news

Curated news and resources on COVID-19

Freeride skiing

Video, powder and other cool stuff for riders

Gadgets I lust for

I can't afford to buy all the cool geek stuff out there. So I collect them here instead. Feel free to suggest yours!

Good news from the Stars

To boldly go where only Astrophysicians have gone before. What I find interesting (and can roughly understand) in Astronomy & Space exploration these days.

Ideas for entrepreneurs

Serial entrepreneurship is constant learning.

Here's what I found impacting.

Is the iPad a revolution?

Will it save the media? create new consumptions patterns?

Lean content marketing

Making the most efficient and effective use of strategies, tools, and technology for content marketing.

Online Gaming For The Win

Used to play a WoW paladin for years. Now looking at what will be the new trends in online gaming.

Scoop.it showcase

Examples of customization (topics and newsletters) done by our designer.

Social media publishing and curation

If you're just tweeting links, you're missing out. Discover and share with us useful resources to maximize the impact of the content we share.

Thought leadership and online presence

Demonstrate Thought Leadership by Building your Online Presence; relation to Content Curation and Personal Branding

|

This is an interesting response to Elizabeth Yin's post on why you can't find a technical co-founder that she wrote on Andrew Chen's blog.

She claimed your best chance was to learn to code and build your MVP on your own: this will not only ensure your MVP will be an MVP but also that you learn from it and in the process be more credible to and respected by your future CTO. Thomas Kjemperud doesn't disagree with the second part but claims there's no need to learn to code to do so: with all the open API's and existing tools out there, you should be able to build something semi-automated without even having to learn to code.

He's got a good point: to get 50 users to really love your service or product, do you really need a completely automated piece of software? Or do you need tools that let you deliver the value prop and makes sure it makes those 50 people happy?

It probably depends but the important thing is that you have to learn from these 50 before you do anything else anyway.